The initial a couple creditors uniquely calculated his borrowing capacity and you will offered that loan count having certain conditions and terms. Although not, PQR refused his app because the their financial obligation-to-income rate are more step one. He opposed the mortgage words given by DMS and you can ABC and you can picked aforementioned. Their rate of interest often influence the general sized the ongoing mortgage repayments, making it an important changeable when figuring your house mortgage borrowing from the bank electricity. You will need to think individuals will set you back away from mortgage payments once you’ve gone within the, such council prices, strata fees, electric bills, insurance rates, and you may assets fix. Consider all of our listing below to demonstrably see the real will cost you employed in to purchase a home to put a total budget detailed with all fees.

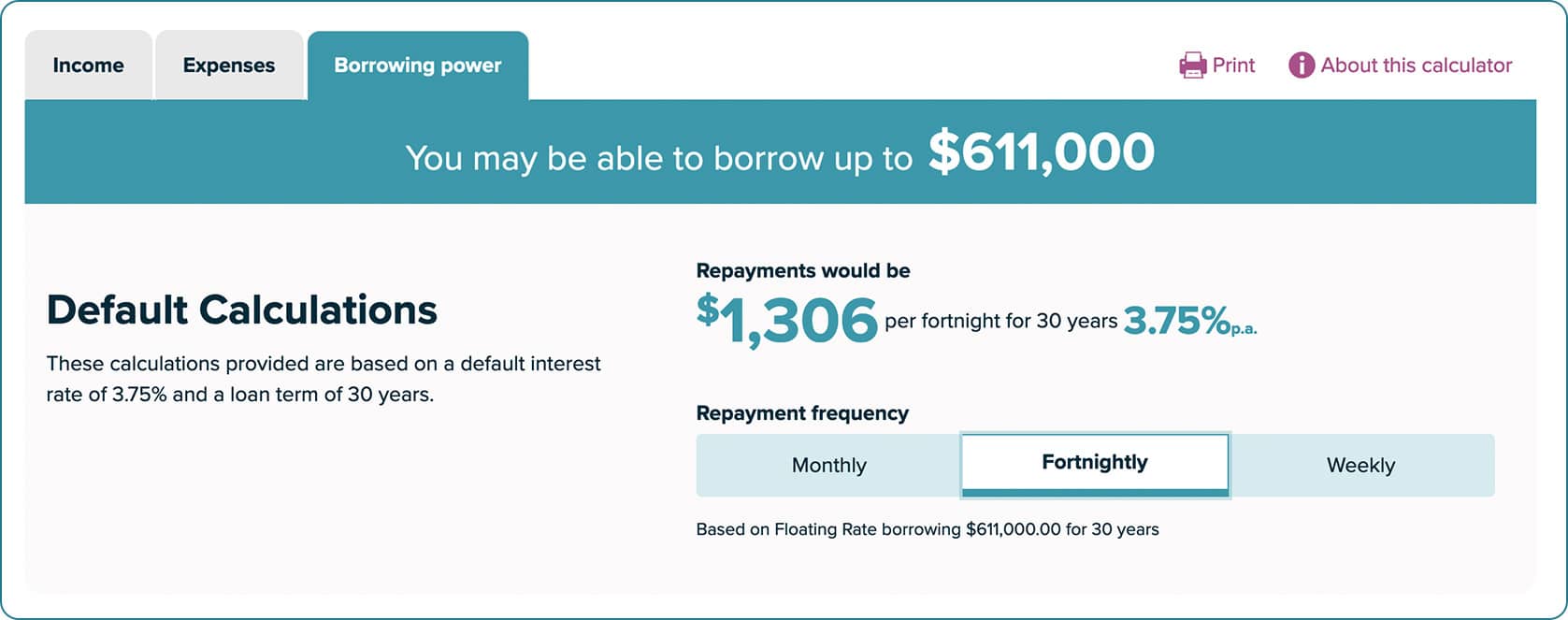

The borrowing strength is actually an approximate formula of one’s ability to borrow funds. Essentially, it’s an indication of just how much you really can afford so you can acquire while you are nevertheless having the ability to see your most other financial obligations. Having fun with our borrowing power calculator will provide you with an idea of what you are able borrow. Find out more about what goes into figuring your own borrowing power.

Borrowing Power Calculator – The Issues

A house using relates to careful planning and you can economic investigation. That it strong tool helps you guess the borrowing from the bank strength, become familiar with investment property Borrowing Power Calculator prospective, and make advised choices regarding the funding options. Borrowing electricity, or limitation borrowing from the bank capability, is the overall amount of cash a lending institution is ready in order to give your to possess home financing. It profile isn’t haphazard; it’s a serious evaluation according to your financial balances and you may element so you can provider the debt.

- Typically, the borrowing electricity is actually calculated since your net income without their costs.

- Full terms and conditions might possibly be lay out within our financing provide, when the a deal is established.

- The financial institution may costs fees for those who request extra financing otherwise make modifications to the mortgage.

- A PriorityBuyer letter are at the mercy of change or cancellation if a questioned mortgage not any longer matches appropriate regulating conditions.

- Any suggestions about this web site will not make up your own objectives, financial predicament otherwise needs and you’ll think whether it’s befitting you.

If not factor these types of inside before applying for a financial loan you might find their credit energy will get much reduced. You should use financing cost calculator to try similar calculations based on your circumstances. This will help you obtain a good thought of that which you find the money for borrow.

Most other information+Tiimely Home is known for the prompt approvals to own Tiimely Own products and responsive service, powered by our tech and you may backed by we of professionals. App and you will acceptance moments is rates only and never guaranteed. Software for a Tiimely Own financing may require a keen assessor to receive more information.

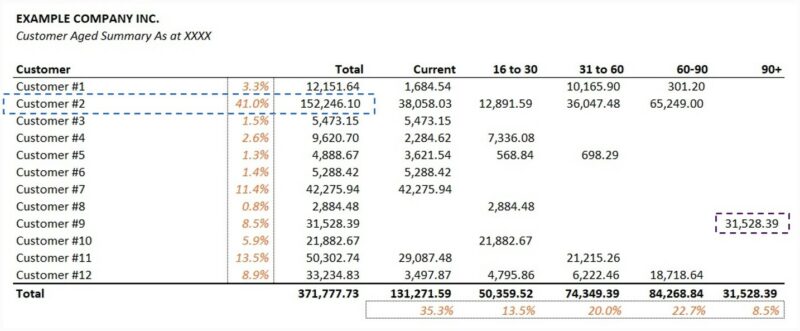

So that you can also be bundle, finances, examine and you can store with confidence. Your debt-to-money ratio (DTI), just like your credit score, plays a part in choosing your own financial eligibility. The tables function all lenders provided by lenders to your our databases one to match the research requirements picked. Lenders don’t shell out to feature in our dining tables, nor do we secure fee for those who simply click to visit a great lender’s web site.

A good 25 or 29 year mortgage can be standard, however, a longer name can lessen your instalments. Advertised interest rate compatible a good $step 1,693 30 days mortgage repayment. The newest trade-out of is the fact that second causes over $23,one hundred thousand extra inside focus repaid along the lifetime of the mortgage. Calculate your projected home loan repayments and see how an interest changes you may effect your allowance. But not, all the lender and financial features its own analysis speed to own estimating the borrowing from the bank strength, for this reason their borrowing electricity can vary anywhere between various other loan providers.

- That it effortlessly develops the borrowing from the bank energy since you don’t need arranged more income to have LMI and you can instead can be place much more to your deposit or other can cost you.

- The total amount you’re in a position to borrow will depend on your debts.

- Remember that our borrowing from the bank strength calculator brings only a keen imagine and won’t make sure you will be acknowledged for this number.

Rates of interest and charge

Discover ways to be more alert to too many “faucet and you may wade” requests when you’re serious about protecting a deposit and purchasing a house. All of our purpose is always to help Aussies arrive at their property desires smaller. We can evaluate 1000s of mortgage brokers of over twenty-five leading loan providers. Focus on the newest number to get an initial imagine of your credit power.

What’s an excellent financial obligation-to-income proportion for home financing?

If you would like focus more about estimating month-to-month payments, our house financing repayments calculator will help make you a clearer picture of possible costs. The couples make up united states to have adverts that appear to your our very own site. So it settlement helps us render devices and you can functions – including 100 percent free credit score availability and you may monitoring. Other factors is the borrowing from the bank character, unit availability and exclusive site strategies. Yes, which have delinquent credit debt may lower your borrowing from the bank strength, also it can become something you should address before you apply to possess a home loan.

Home loan Words You have to know Before you apply

Below are a few all of our on the internet rate disregard for the all of our first adjustable house financing or funding mortgage. Implement online, and pick an excellent Flexi Basic Choice financing to your Dominant & Interest money. It size is designed to get rid of financial system risks since the homes borrowing from the bank progress and you can cost go up. Lenders decide how much you might obtain based on what exactly is recognized since the serviceability data. This type of data be the cause of your revenue along with your expenses.

That it formula is not an offer away from borrowing but an estimate only away from anything you manage to acquire based on all the information offered and won’t were the relevant charge (apart from month-to-month charge). Your own borrowing power amount can be various other once you over a great complete software so we bring all of the facts relevant to our lending conditions. Our credit conditions and you may base where i determine everything can afford get changes when without notice. Just before performing on it computation you ought to look for expert advice.

This can be making allowances for rent opportunities and you will property fix. Your borrowing power could be straight down when you yourself have a lot of debt, worst economic management feel, less than perfect credit and a decreased put. Alternatively, there will be higher credit electricity for those who have low personal debt, practical existence costs, a huge deposit and you will sufficient assets.

Removalist, paying off to your house will set you back

An excellent credit power usually refers to the capability to comfortably afford that loan considering your earnings, expenditures and you can full financial predicament. This means that have an acceptable earnings relative to your financial situation and you can living expenses, enabling you to meet mortgage repayments instead straining your allowance. Preserving more money to have a home put increases your borrowing from the bank ability as the lenders find a regular preserving number. That have a larger deposit along with decreases attention repaid, as well as your monthly payment, too. Borrowing electricity will depend on examining if your current economic things will allow you to provider your own home loan across the specified financing period.